Us Tax Brackets Married Filing Jointly 2025. For instance, married taxpayers who file jointly and earn more than $23,850 (the top threshold for the 10% bracket in 2025) could owe $2,385 in federal income tax — or 10%. To figure out your tax bracket, first look at the rates for the filing status you plan to use:

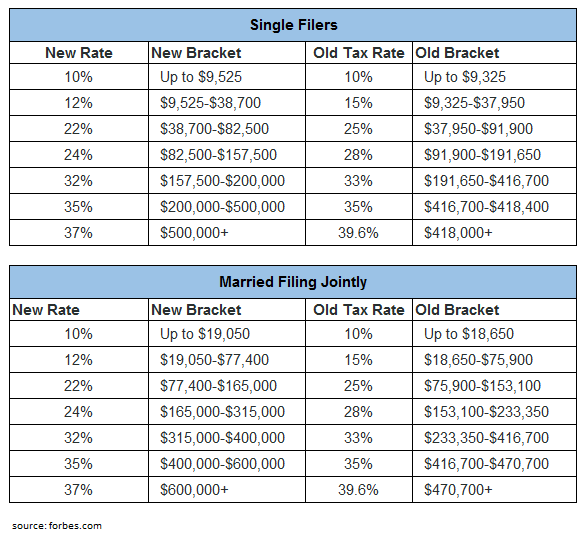

12% for incomes over $11,600 ($23,200 for married couples filing jointly) the highest rate is 37% for individual single taxpayers with incomes greater than $609,350. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $626,350 for single filers and above $751,600 for married couples filing jointly.

Us Tax Brackets 2025 Married Jointly Vs Separately Karen Smith, Your tax bracket depends on your filing status (single, married, filing jointly, etc.), and each status has different income ranges.

2025 Tax Rate Tables Married Filing Jointly Ethan S. Coe, Married taxpayers filing separately 2025 projected.

Tax Brackets 2025 Married Jointly Theo Adaline, In this article, we’ll break down how to determine the tax bracket you’re in, the new bracket thresholds for.

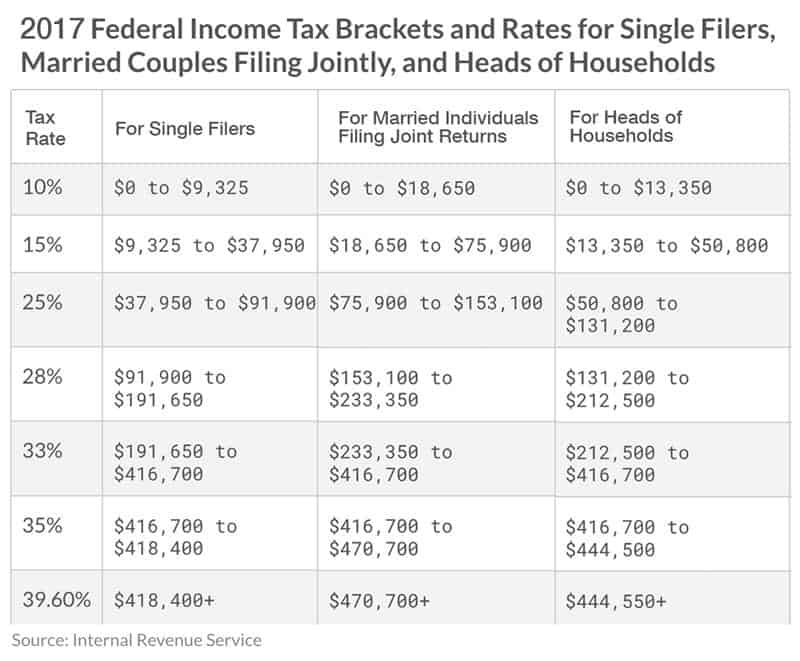

2025 Tax Brackets For Married Filing Jointly Beginning Of Ramadan 2025, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37.

2025 Tax Brackets Calculator Married Jointly Ryan Greene, 2025 alternative minimum tax (amt) exemptions filing status

What Is The Minimum To File Taxes 2025 Virginia Davidson, Married taxpayers filing separately 2025 projected.

Tax Brackets 2025 Married Filing Jointly Single Darya Emelyne, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37.

New Tax Brackets 2025 Married Jointly Hinda Leelah, For heads of households, the standard deduction will be $22,500 for tax.

Us Tax Brackets 2025 Married Jointly Vs Separately Karen Arnold, For individuals, that rate kicks in at $626,350.

Tax Brackets 2025 Married Jointly Theo Adaline, Here's a look at how certain tax thresholds and credits will shift for the 2025 tax year, plus a comparison to 2025.